What is EMI | How to Calculate it | Why It Matters

Introduction

Equated Monthly Installments, commonly known as EMIs, are a fundamental aspect of personal finance that touches the lives of millions of people. Whether you’re dreaming of buying a home, or a car, or simply need a personal loan, understanding EMIs is crucial. In this article, we’ll delve into the concept of EMIs, explain the formula to calculate them, and shed light on their significance in managing your finances effectively.

What is EMI?

The Building Block of Borrowing

EMI stands for Equated Monthly Installment. It is a fixed monthly payment that borrowers make to lenders, encompassing both the principal amount borrowed and the interest charged. EMIs are the lifeblood of loans, ensuring borrowers can manage their repayments consistently.

The EMI Formula

Crunching the Numbers

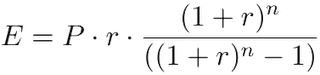

Calculating EMI involves a precise mathematical formula:

EMI = P * r * (1 + r)^n / ((1 + r)^n – 1)

- EMI: Equated Monthly Installment

- P: Principal amount

- r: Monthly interest rate (annual rate divided by 12)

- n: Loan tenure in months

This formula provides borrowers with a clear understanding of their monthly financial commitment. Let’s break it down step by step:

- Calculate the monthly interest rate (r) by dividing the annual interest rate by 12, expressed as a decimal.

- Use the formula to compute the EMI, which remains consistent throughout the loan tenure.

Why EMI Matters

Predictability and Financial Planning

EMIs offer several advantages:

- Budgeting: EMIs help borrowers plan their monthly finances effectively. Knowing the fixed amount due enables better budgeting and prevents financial surprises.

- Consistency: Regardless of market fluctuations, EMI amounts remain constant, providing stability and peace of mind.

- Principal Reduction: Over time, a larger portion of each EMI goes towards repaying the principal, accelerating the loan repayment process.

Call to Action

Now that you’ve unlocked the secrets of EMIs, it’s time to put this knowledge to use. Whether you’re considering a home loan, a car loan, or any financial borrowing, understanding EMIs empowers you to make informed decisions. Take control of your financial journey, plan wisely, and secure your future.

Intrigued by financial topics like EMIs? Explore our website for more insightful articles and resources on managing your money effectively.

Remember, financial literacy is the key to financial freedom. Start your journey today.